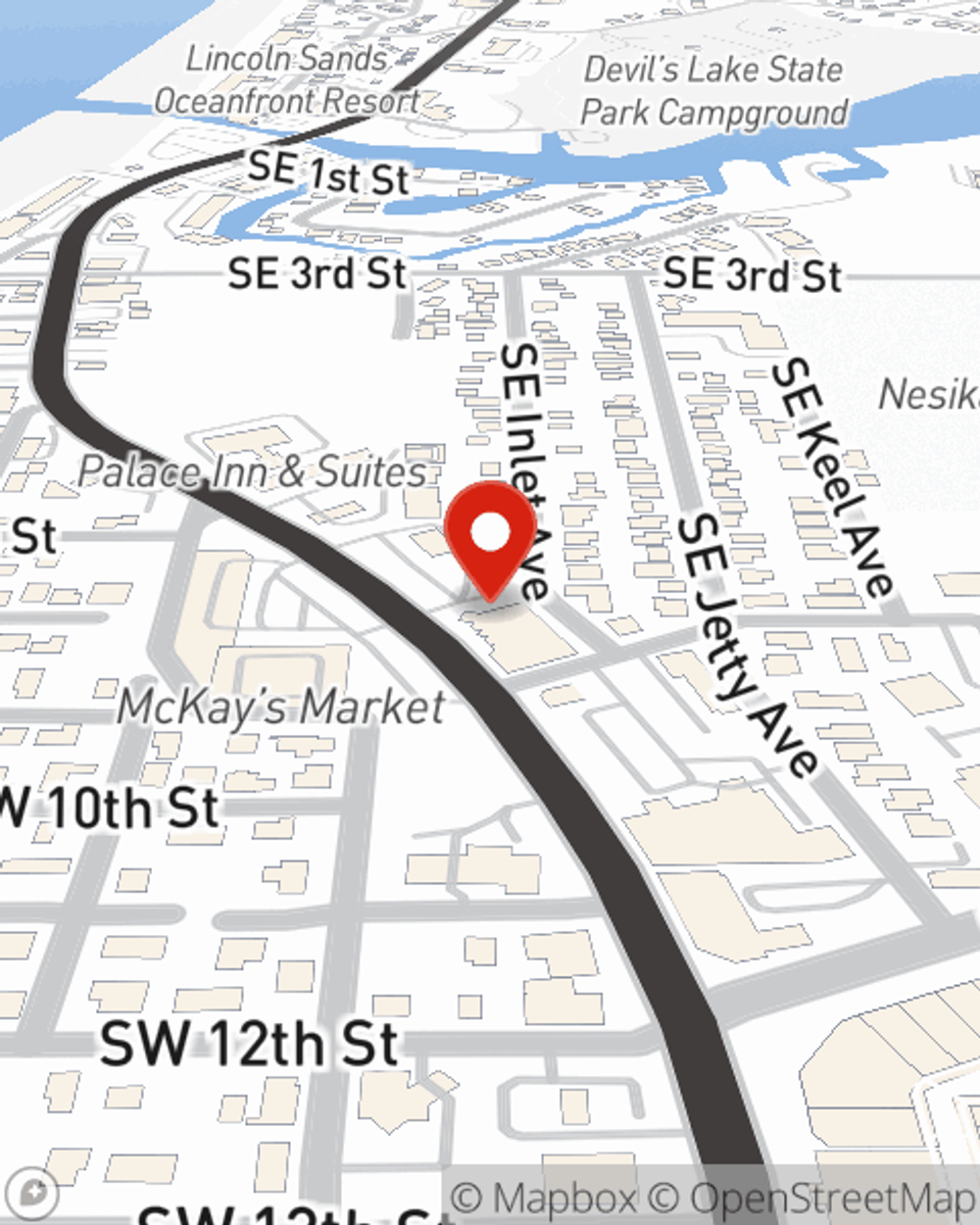

Business Insurance in and around Lincoln City

One of the top small business insurance companies in Lincoln City, and beyond.

Cover all the bases for your small business

- Lincoln City

- Newport

- Salem

- Tillamook

- Eugene

Help Prepare Your Business For The Unexpected.

Do you own a stained glass shop, a home cleaning service or a veterinarian? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on navigating the ups and downs of being a business owner.

One of the top small business insurance companies in Lincoln City, and beyond.

Cover all the bases for your small business

Protect Your Business With State Farm

When one is as passionate about their small business as you are, it is understandable to want to make sure everything is in order. That's why State Farm has coverage options for business owners policies, surety and fidelity bonds, artisan and service contractors, and more.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Brandon Carpenter's team to identify the options specifically available to you!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Brandon Carpenter

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.